COVID-19 Financial Support

The Government has developed three online assessment tools to help businesses:

- Business Support Finder – This tool allows employers and the self-employed, including sole traders and limited company directors to determine their eligibility for Coronavirus Job Retention Scheme, loans, tax and rate relief and cash grants.

- Business Risk Assessment – This tool is to help business operators develop a risk assessment tailored to the specific circumstances of their business and provides advice on how work practices can be changed to mitigate any risks identified.

- Employee Risk Assessment – This tool is to help employees determine whether they should be going back to work or whether they should continue to work from home and includes advice specifically for tourism related businesses.

If your business is in distress, the Government have also published guidance on available support, restructuring and insolvency advice here.

The Department for Business, Enterprise and Industrial Strategy (BEIS) is encouraging businesses across England to contact their local Growth Hub, they can provide a free to use, impartial and local single point of contact to all businesses, so that they can access the right advice and support. Find your local Growth Hub here.

Government Business Support

Additional Restrictions Grant (ARG) (England)

On 21 December 2021, the Government announced that a further £102 million would be made available for Local Authorities, through a top-up to the Additional Restrictions Grant. Councils are specifically encouraged to provide funding for the travel and tourism sector. All ARG funding, including this tranche, need to be dispersed by 31 March 2022.

Download the guidance document for local authorities.

Click here to check your eligibility.

How to apply – This grant will be distributed via your local authority. Click here to find your local authority.

Omicron Hospitality and Leisure Grant (England)

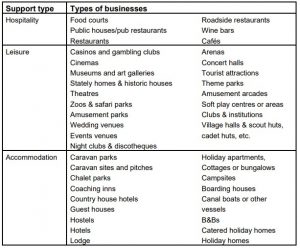

Provides local councils with one-off grant funding to support to hospitality, leisure and accommodation businesses, in recognition that the rise of the Omicron variant means that some businesses are likely to struggle.

This table sets out types of businesses that are eligible under the sector thresholds for this scheme. This list is not exhaustive, but indicative of the types of businesses that can be supported under this scheme.

Download the guidance document for local authorities.

Click here to check your eligibility.

How to apply – This grant will be distributed via your local authority. Click here to find your local authority.

Tourism top-up funding (Scotland)

VisitScotland will administer payments worth up to £9 million to the tourism industry as part of a multi-million-pound funding package for businesses impacted by the spread of the Omicron variant.

The following will be be eligible for top-up grants:

- coach operators

- day tour operators

- hostels

- inbound tour operators

- outdoor / marine

- visitor attractions

Click here to check your eligibility.

How to apply – This grant will be distributed via VisitScotland. Click here to find out more.

Economic Resilience Fund (Wales)

The Economic Resilience Fund (ERF) is targeted at businesses in the hospitality, leisure and attraction sectors and their supply chains who have been materially impacted by a greater than 50% reduction of turnover between 13th December 2021 and 14th February 2022. Eligible businesses can apply for grants of between £2,500 to £25,000, with grants dependent on their size and number of employees. The application window for the ERF will open in week commencing 17 January 2022, with payments starting to reach businesses within days.

Click here to check your eligibility.

How to apply – Click here to apply.

Non Domestic Rates linked grant (Wales)

Non-essential retail, hospitality, leisure and tourism businesses in Wales will also receive support from the Non Domestic Rates (NDR) linked grant. Businesses will be entitled to a payment of £2,000, £4,000 or £6,000 depending on their rateable value. Registration will open via local authority websites from the 10 January 2022. Local Authorities will also deliver a discretionary fund to support sole traders, freelancers and businesses who don’t pay rates, with grants of £500 – £2000.

How to apply – This grant will be administered by local authorities. Click here to find out more.

Other support packages

- Business Rates Relief – You could qualify for rates relief if your property is a shop, restaurant, café, bar or pub, cinema or live music venue, assembly or leisure property – for example, a sports club, a gym or a spa or a hospitality property – for example, a hotel, a guest house or self-catering accommodation.

- VAT reduction – If your business is in the hospitality, hotel or holiday accommodation sectors you may be eligible for the 12.5% reduced rate in VAT until 31 March 2022.

- Eviction protection – The existing measures in place to protect commercial tenants from eviction has been extended to 25 March 2022.

- Live Events Reinsurance Scheme – On 5 August 2021, the government announced that it is partnering with insurers to offer a cost indemnification insurance scheme which will make cover available against the cancellation, postponement, relocation or abandonment of events due to new UK Civil Authority restrictions in response to COVID-19. The Scheme will run to 30 September 2022 with a review point in Spring 2022.